What is a like-kind exchange?

The purest form of exchanging is a simultaneous “swapping” of properties directly between (2) parties. Often, there are practical reasons why a simultaneous exchange cannot be accomplished. Your new property may not be located yet in order to close at the same time as your sale or old property. Thus, the delayed exchange developed, which consists of a sale and a reinvestment or purchase of a new property within an exchange period.

Are the rules for an exchange the same as the rules for selling a primary residence?

No. The rules for primary residence (Section 121) are completely different. The exchangor needs to document the intent to exchange prior to the sale of the property and comply with the rules set forth by the IRS for qualified exchanging.

What are the requirements for an exchange to be valid?

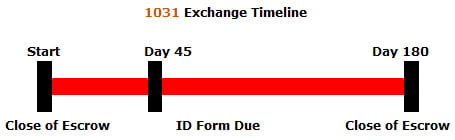

You must complete the sale of the old property and reinvest or purchase the new property within 180 days. The 45-day identification period begins upon sale of your property. The exchangor needs to locate property and designate potential new property within that time. In other words, you must identify your “shopping list” of possible new like-kind properties.

What is considered like-kind property?

“Like-kind” refers to the type of property being exchanged or the kind or class definition of the property by the IRS. The grade or quality of the property is not the issue. In other words, raw land could be exchanged for a commercial building or for any improved property and still be considered “like kind”. Real property must be exchanged for real property and personal property (IFQ’s, permits, vessels, and airplanes) must be exchanged for the kind or class of the property definition. Both the property for sale and the new property must be held for investment, business use or rental purposes for a minimum of 1 year.

Are there extensions to the time frames or any exceptions to the rules?

No. The rules and time deadlines are absolute. Implementing an exchange strategy will minimize their effect.

Why do I need a Qualified Intermediary?

A Qualified Intermediary acts on behalf of the exchangor as a trustee. Alaska Exchange Company will help you determine an exchange strategy considering your personal situation, investment history, new goals and how these plans maybe affected by Section 1031. The Qualified Intermediary provides documentation and coordination through completion of the exchange. It is your bonded guarantee that your exchange is accomplished according to IRS regulations.

Who can act as my Intermediary?

As defined by regulations, the intermediary must be a disinterested party who is not your friend, relative, agent/broker, attorney, accountant or employee in order to act in this capacity. Qualified intermediaries are defined as a “safe harbor” for protecting your exchange.

Can I put my proceeds in my own separate account and not touch them and still qualify for the exchange?

No. To meet IRS requirements for a delayed like-kind exchange, you can never have actual or constructive receipt of the exchange funds during the exchange. You must give up control over your exchange funds to the intermediary during the exchange period. In reality, you are turning your money over to a stranger. KNOW YOUR INTERMEDIARY!!

How can I insure the safety of my funds?

Your money should be held in insured no-risk accounts, earning interest for your benefit. All exchange accounts should be insured by a Fidelity Bond against any loss caused by theft, embezzlement or any other act of dishonesty.

Is the exchange “tax free”?

No. It is a deferral of capital gain and depreciation taxation, or a rollover which would be due upon the ultimate sale of the property. However, there are benefits for your heirs upon receiving exchanged property, which could diminish or eliminate the taxes for them.